san antonio general sales tax rate

The minimum combined 2022 sales tax rate for San Antonio Texas is. Maintenance Operations MO and Debt Service.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

. City sales and use tax codes and rates. This includes the rates on the state county city and special levels. Easily manage tax compliance for the most complex states product types and scenarios.

The current total local sales tax rate in San Antonio FL is 7000. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. While many other states allow counties and other localities.

Ad Seamless POS System Integration. This is the total of state county and city sales tax rates. The City of San Antonios Hotel Occupancy Tax rate is 9.

The average cumulative sales tax rate in San Antonio Texas is 822. San Antonios current sales tax rate. What is the sales tax rate in San Antonio Florida.

On-Time Sales Tax Filing Guaranteed. The property tax rate for the City of San Antonio consists of two components. The 78216 San Antonio Texas general sales tax rate is.

San antonio city council approved on Thursday the sale of five properties it owned in. The current total local sales tax rate in San Antonio TX is 8250. The December 2020 total local sales tax rate was also 7000.

San Antonio collects the maximum legal local sales tax. Ad Accurately file and remit the sales tax you collect in all jurisdictions. San Antonio Sales Tax Rates for 2022.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a. The December 2020 total local sales tax rate was also 8250. The minimum combined 2022 sales tax rate for San Antonio Florida is.

Texas Comptroller of Public Accounts. Easily manage tax compliance for the most complex states product types and scenarios. Download all Texas sales tax rates by zip code.

The latest sales tax rates for cities in Texas TX state. The December 2020 total local sales tax rate was also 63750. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Rates include state county and city taxes. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in. This is the total of state county and city sales tax rates. You can print a 7 sales tax table here.

The zone was established in. Sales and Use Tax. View the printable version of city rates.

Object moved to here. What is the sales tax rate in San Antonio Texas. 2020 rates included for use while preparing your income tax deduction.

The current total local sales tax rate in San Antonio NM is 63750. DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

There is no applicable city tax or special tax. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling. The state sales tax rate in Texas is 625 but you can customize this table as needed to reflect your applicable local sales tax rate.

City Sales and Use Tax. San Antonio has parts of it located within Bexar.

Worksheet For Completing The Sales And Use Tax Return Form 01 117

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Understanding California S Sales Tax

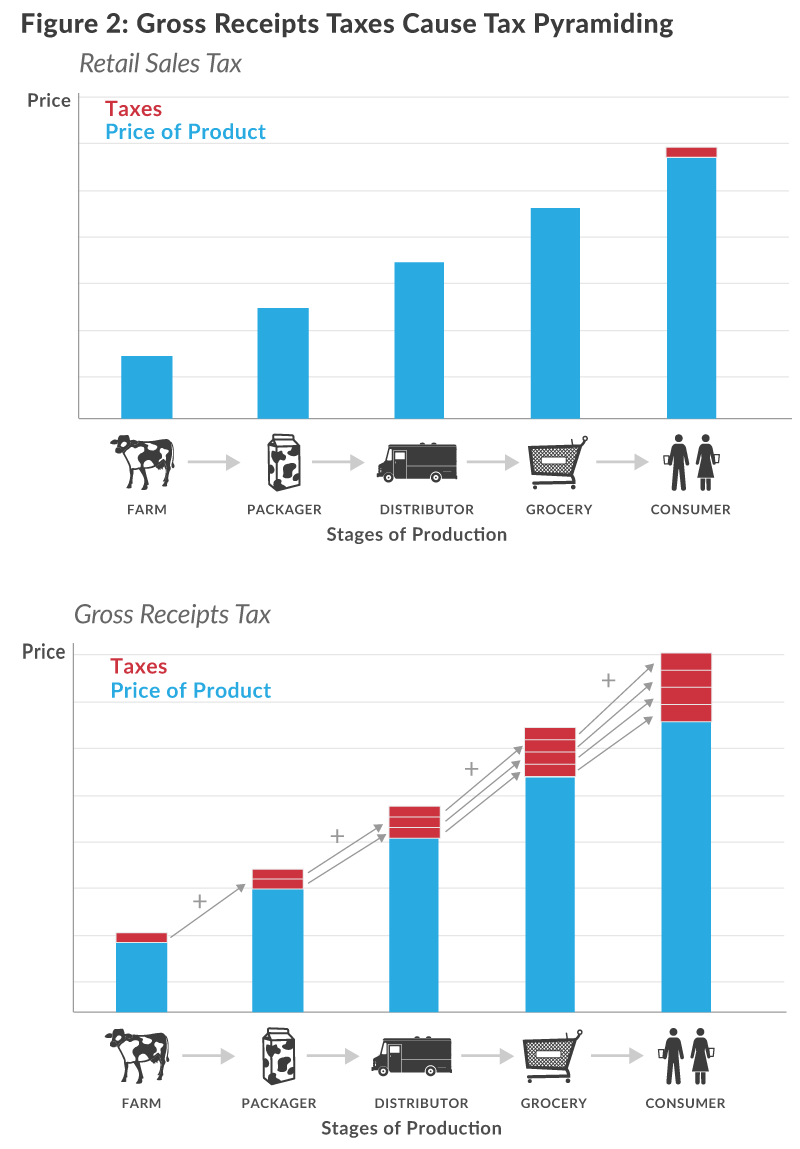

The Texas Margin Tax A Failed Experiment Tax Foundation

Understanding California S Sales Tax

Understanding California S Sales Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Calculate Sales Tax On Almost Anything You Buy

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath